Rupay Credit Card News: Here and fantastic update on rupay credit card, Starting 1st Septemeber 2024, RuPay Credit Card users will receive the same reward points on UPI payments as other credit card holders. This is some really good news for Rupay credit card holders. If don’t have any rupay credit card then I would suggest you to get one from below top rupay credit cards.

Apply Axis Bank Rupay Credit Card. Check some cards review here

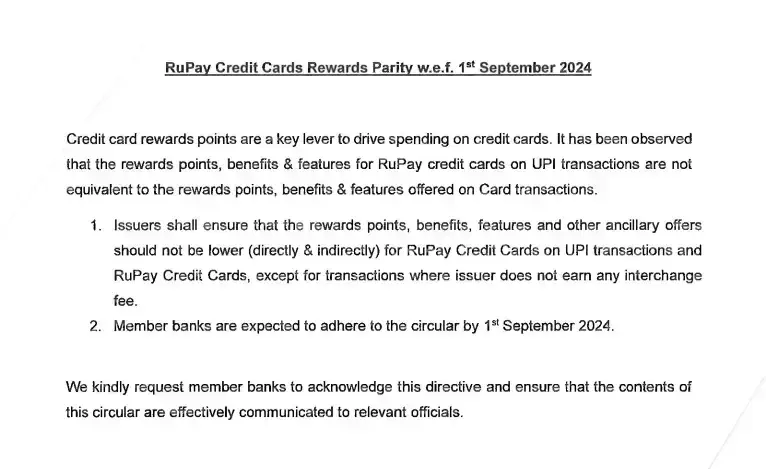

The National Payments Corporation of India (NPCI) has directed all banks operating in India issuing RuPay credit cards to ensure that the reward points and other specified benefits are not lower for RuPay credit cards on UPI transactions made on RuPay credit cards. This directive by NPCI is effective from September 1, 2024.

Rupay Credit card news dated 5th Aug 2024

From the above image which is an official source say this “Credit card rewards points are a important factor to drive spending on credit cards. It has been observed that the reward points, benefits and features for RuPay credit cards on UPI transactions are not equivalent to the rewards points, benefits and features offered on card transactions and we have also seen in recent that earlier some good rewards was there for upi transaction o rupay credit cards but now many banks have been reducing the reward and benefits.

Issuers shall ensure that the reward points, benefits, features and other ancillary offers should not be lower (directly and indirectly) for RuPay Credit cards on UPI transactions and RuPay credit cards, except for transactions where the issuer does not earn any interchange fee,” said NPCI in a circular dated August 5, 2024″

What is a RuPay Card?

A RuPay card is proudly an Indian debit or credit card that is part of a domestic payment network launched by the National Payments Corporation of India (NPCI). The name RuPay is derived from the words “rupee” and “payment”. RuPay cards are introduced into the Indian market to be an alternative to international payment networks like Visa, Mastercard, Amex and offer a variety of benefits, including lower transaction costs for merchants Faster transaction processing Wider acceptance is in rural areas of India.